About Us

TrustBridge simplifies global giving by expertly managing and delivering donations worldwide through its affiliate offices, providing a faster, easier, and more cost-effective solution than other options.

Our Story

TrustBridge Global Foundation is the Swiss-based hub of a global charitable payment and impact investing platform for charities and donors to resource good works around the world.

We are the first donor-advised fund (DAF) to be truly global.

Our Mission

To mobilize resources by making

global giving easy.

Our Vision

Charities everywhere have all they need to accomplish their mission.

A simple concept with a huge impact.

Through our range of international giving solutions, TrustBridge offers a safe, easy, and efficient method for making tax-deductible gifts to charities in other countries, so that donors from almost any part of the world can give to charities in almost any part of the globe.

Our Core Values

Put people first.

The world tells us that we need to decide between benefiting ourselves or benefiting others. In all situations, we will choose to apply the Golden Rule and treat others as we would like to be treated. We put people first and lean into generosity. People are more important than dollars.

Find a way to say yes.

Our team is comprised of some of the smartest, most gifted people around. We believe our clients deserve maximum effort and creativity applied towards the accomplishment of their goals. While we always need to consider costs and potential risks, we should exhaust every reasonable alternative before we say “no, we can’t do it”.

Move as fast as possible, but not faster.

In serving clients, time is of the essence. Non-profit charities should not operate at a lower standard than for-profit businesses. We strive for world-class responsiveness to client needs, while not compromising compliance with applicable laws and regulations, or our standard of excellence. Additionally, as we innovate, we move those solutions into production with real world urgency.

Trust Our People to Act.

We believe in our people – their gifts, skills, and worth - and therefore we trust our people. We are self-starters and take action without waiting to be told. But not necessarily on our own – we listen and collaborate. We provide everyone with the training, strategic clarity, and radical information-sharing necessary to make wise decisions.

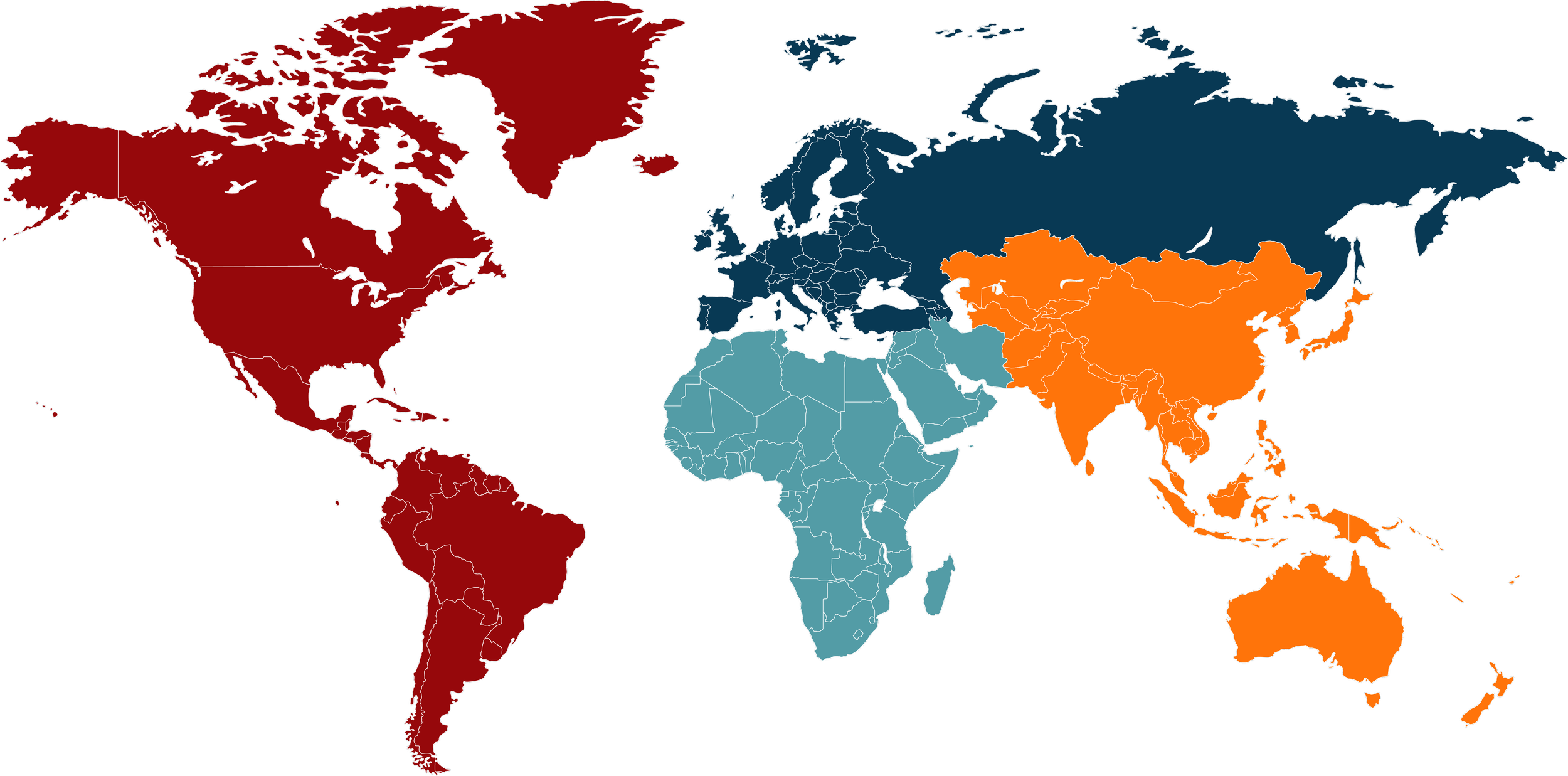

Our Global Network

TrustBridge is developing a growing network of like-minded charities and foundations in countries all over the world.

As our network grows, our ability to give effectively and efficiently grows as well.

Our Network Members

Americas

Europe

Croatia

Czech Republic

Germany

Netherlands

Leven en Getuigenis

Romania

Spain

Switzerland

United Kingdom

Middle East & Africa

South Africa

Asia & Oceania

Australia

New Zealand

Philippines

The TrustBridge Global Network is an affiliated network of like-minded foundations in countries across the globe with over $9 billion in combined assets. Network Members agree to collaborate and work across borders to help facilitate grantmaking and increase generosity around the world.

To know more about becoming a Network Member:

Our Team

Our team is an exceptional group of experienced professionals that brings together world-class expertise in finance and cross-border giving. It includes bankers, tax specialists, legal experts and philanthropy advisors. We have strategic relationships with leading global banks and technology providers to deliver a seamless end-to-end philanthropy solution.

Careers

Want to join the TrustBridge team?

Join a global movement of generosity that is mobilizing unprecedented resources for charities everywhere.